From January 2022, Experteye has developed a Car Leasing Index for new full-service leasing contracts. It is based on major leasing companies leasing rates and can be considered as a good representation of the market trends (over 17.000 leasing prices per month).

The index includes financing and key services as maintenance and assistance and therefore reflects a combination of new car prices, incentives, residual values, aftersales costs and interest rate variations. Each leasing parameter as mileage-durations, taxation, model-mix have been retreated, to provide a very precise and realistic picture of the market price evolution.

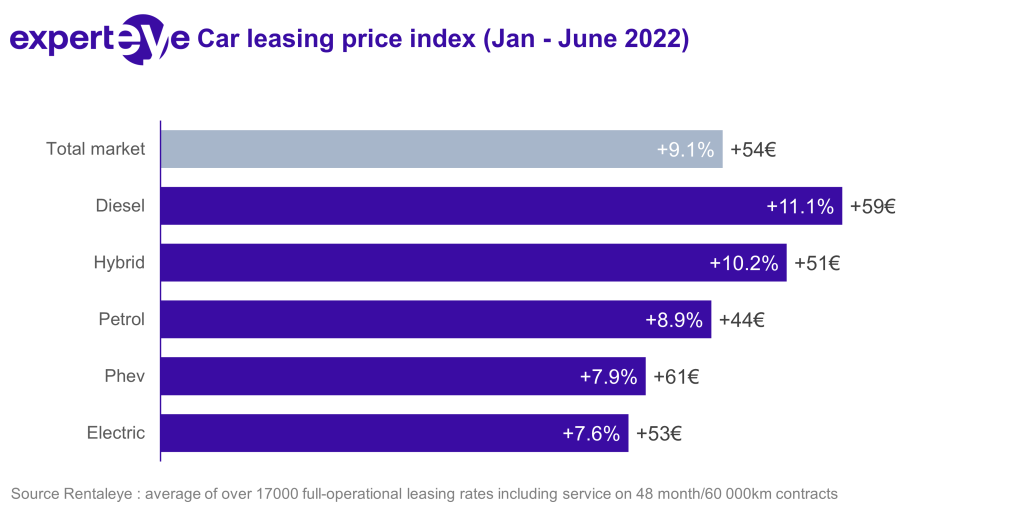

Leasing prices increased more than consumer prices in the last 6 months

At the end of June, the index stands at +9.1%, when official price index has moved from 109.1 to 114.1 (representing 4.65 points increase). It means that leasing prices have increased by 9.1% during the first 6 months of the year while consumer prices went-up “only” 4.25%. This is understandable considering that OEM have drastically reduced their discounts while three years interest rates swap became positive at the end of January (-0.16% 31/12/2021) and has reached 2.0 % at the end of June. Leasing companies are generally refinancing their contracts over three or four years.

Prices evolution favours fleet electrification

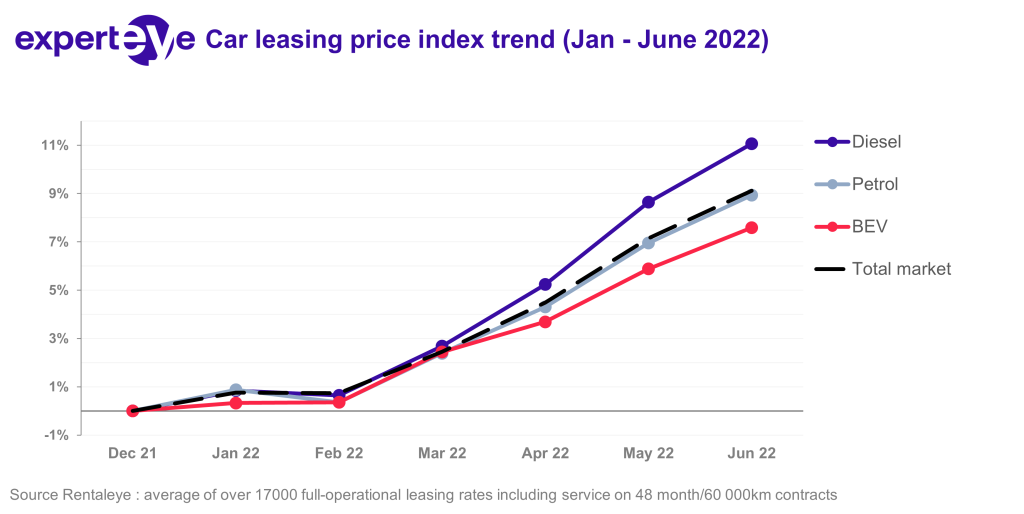

We can see a massive increase of prices from March onward and a major acceleration in April (+5.5%) which might be explained through a quarterly adjustment from leasing companies facing substantial refinancing costs increases.

Nevertheless, we observe an interesting movement penalising Diesel with 11.1% increase while electric increase by 7.9%. Most leasing companies are willing to support the transition toward electric vehicle and their pricing policy is certainly the best way forward.

Pascal Serres

Board member at Experteye.

Board member at Nexus communication.

Click here to learn more about our leasing market pricing product.