From January 2022, Experteye has developed a Car Leasing price Index for new full-service leasing contracts. It is based on major leasing companies lease rates and can be considered as a good representation of the market trends. We consider over 10.000 leasing prices per month.

The index includes financing and key services as maintenance and assistance and therefore reflects a combination of new car prices, incentives, residual values, aftersales costs and interest rate variations. In order to provide a very precise and realistic picture of the market price evolution, we retreat each leasing parameter as mileage-durations, taxation, model-mix.

Leasing prices increased more than consumer prices in the first semester

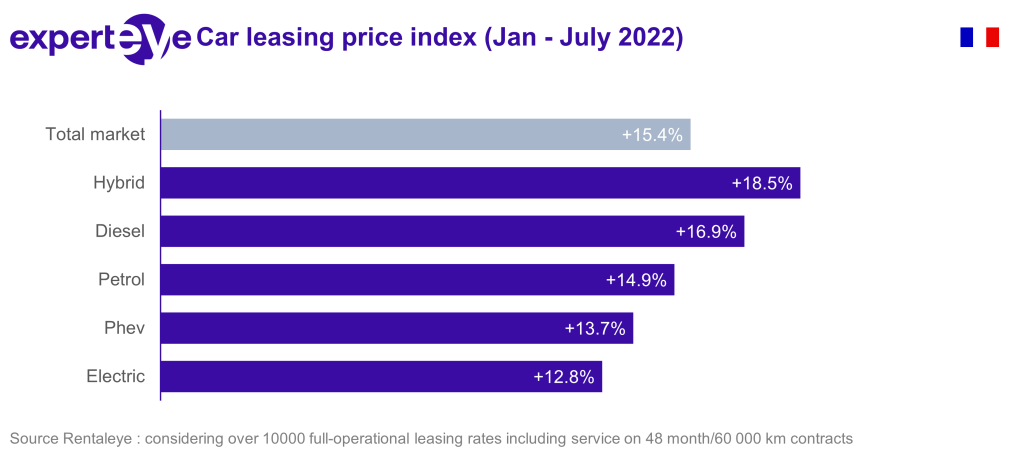

During July, the experteye car leasing price index remains above the official consumer price index. It means that leasing prices have increased by 15.4% starting the second semester while consumer prices went-up “only” 5.8%. This is understandable considering that OEM have drastically reduced their discounts while three years interest rates swap became positive at the end of January (-0.16% 31/12/2021) and has reached 2.0 % at the end of June. Leasing companies are generally refinancing their contracts over three or four years.

Prices evolution favours fleet electrification

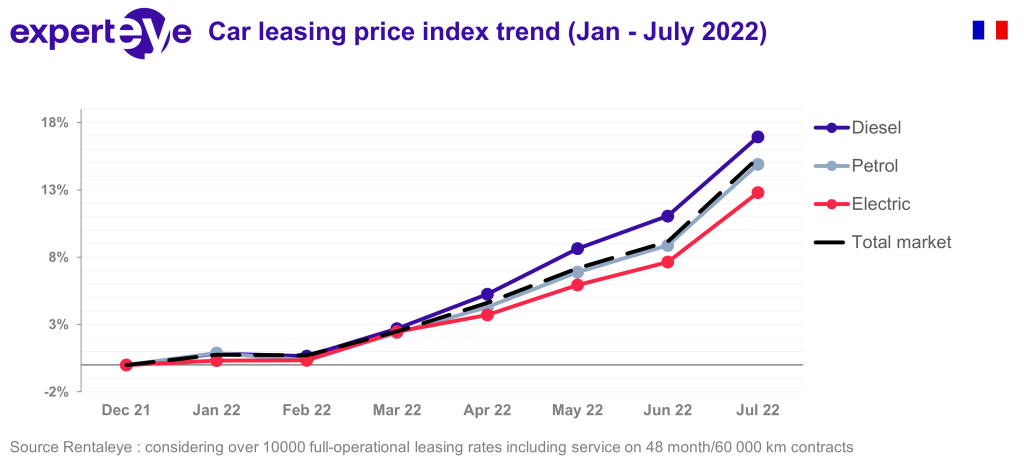

We can see a significant increase of prices from March onward. A first acceleration in April (+5.5%) and a major one in July (+15.4%). An increase explained through a quarterly adjustment from leasing companies facing substantial refinancing costs increases.

Nevertheless, we continue to observe an interesting movement penalising Diesel with 18.5% increase while electric increase by 12.8%. Most leasing companies are willing to support the transition toward electric vehicle. Therefore, redefining their pricing policy is certainly the best way forward.

Click here to learn more about our leasing market pricing product.